The Equity Collective

Building a startup can be a lonely journey. In addition, too many aspiring entrepreneurs never start, and too many pre-seed businesses fail, because they lack expert feedback and proper focus during the earliest stages.

To give entrepreneurs a critical support network to help them across the entire lifecycle of their business, the Accelerativ developed a groundbreaking Equity Collective where everyone shares equity in the companies formed from each program cohort.

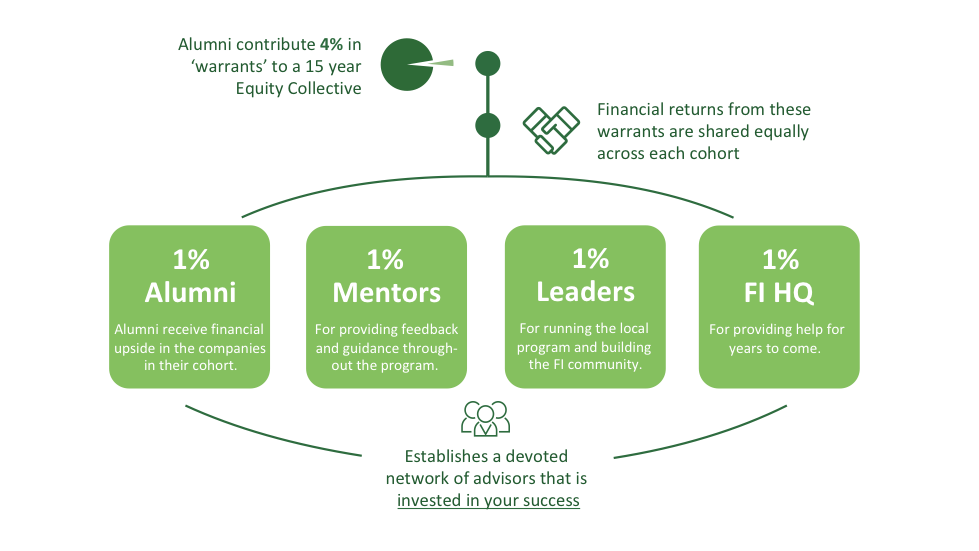

Here's how it works - about halfway through each program, companies contribute 4% in Warrants to a fifteen-year Equity Collective with other peers from the current cohort. Any financial returns we receive from this Equity Collective are then shared equally across each cohort:

- 3/4 of the Pool Returns go back to your Local Cohort

- 1/4 goes right back to the program Alumni, split evenly.

- 1/4 goes to the program Mentors, and each Mentor's individual share is based solely on anonymous ratings received from the Alumni. This incentivizes Mentors to take an active role in each cohort's success.

- 1/4 of the Pool Returns go to the Local Leaders for their efforts in organizing, building, and running the local cohort.

- 1/4 of the Pool Returns go to the Accelerativ, which provides operating capital for the business.

Why Shared Equity?

There are several main benefits to the Accelerativ Shared Equity Collective model.

Teamwork

Starting a technology company is one of the hardest and loneliest things you can do. As Elon Musk once famously said, Entrepreneurship is like eating glass and staring into the abyss.

By joining the Equity Collective, aspiring founders ensure themselves a strong support network of new founders just like them, and experienced startup Mentors, who are all vested in their success. In addition, the higher a mentor is rated by the Founders in a cohort, the larger their share of the 25% Mentor allocation becomes. As a result, Mentors are incentivized to help Accelerativ Graduates, and many Mentors become formal advisors or investors as well.

When smart people work together towards a common goal, amazing things can happen.

Community Development

The Accelerativ Vision is to Globalize Silicon Valley and help entrepreneurs across the globe launch meaningful and enduring technology companies. The Shared Liquidity Pool is a key component of our strategy.

- The Equity Collective incentivizes collaboration between new and experienced entrepreneurs in local startup ecosystems, creating a pay-it-forward mentality similar to the one found in Silicon Valley.

- By sharing 75% of the Bonus Pool proceeds back to the local program participants, the Accelerativ facilitates local economic development.

Diversification

The likelihood of one company being successful is small, whereas the likelihood of one successful exit out of 10 companies (the size of an average Accelerativ Graduate cohort) is very high. By joining the Equity Collective, you are diversifying your startup risk, while investing in expert mentorship and upside in your peers.

This diversification strategy has been successfully leveraged by top startup CEOs in Exchange Funds. The Institute innovated on the Exchange Fund model by taking very early stage companies and mandating that each Founder or Founding Team gets one share of the Bonus Pool in exchange for one fixed amount of equity, 4%.

Performance

Even in small acquisitions of $5 MM or less, the financial return from the Bonus Pool far exceeds the average Course Fee by multiple times. To date, the Accelerativ has distributed returns to the Pool of approximately $5M. These exits have returned approximately 10 times the Course Fee for each Founder in the Equity Collective. The Accelerativ predicts that exits from any one semester will occur between five and ten years after the semester ends, which is slightly longer than for the average angel funded startup.

After two years, the average Accelerativ semester with 10 companies has results resembling the following:

- There are approximately 3 leading companies that are well-funded and well-respected in their fields.

- There are 3 strong companies that have raised some capital, have a solid team and are making good progress in their market.

- There are 2 or 3 companies that are still working on their business in a part-time capacity or with limited success, and some of these companies will ultimately be successful, while others will fail.

- The final 1 or 2 companies are either bankrupted or completed stopped.

The very first cohort of the Accelerativ had a post-money valuation determined by private company investors in excess of $300,000,000 three years after graduation. Since investor valuations are normally much smaller than acquisition values, the oldest Accelerativ cohort may be worth in excess of a billion dollars today. Many checks have already been mailed from that cohort, and we expect many more as well!

More questions about the Accelerativ Equity Collective? See our Equity Collective FAQ.